-

What is greenwashing and why it matters

Greenwashing can be broadly defined as misrepresentation, misstatement and false or misleading practices in relation to environmental, social and governance (ESG) disclosure practices of corporations. Examples of greenwashing would include a label indicating that single-use coffee pods are recyclable when really, they aren’t. Similarly, the Canadian Securities Administrators (CSA) considers that a statement on a company’s website that “The Company plans to be carbon neutral by 2050” would also constitute greenwashing in the absence of a description of the issuer’s activities that will allow it to meet the target, and how these will be measured.

Greenwashing matters right now in light of efforts by public and private actors to mitigate climate change. Such efforts have finally come under intense public scrutiny and particular attention is being paid to misleading public statements by corporations regarding their own programs to reduce their carbon footprint and to engage in more sustainable business practices. In response to more frequent news about companies’ greenwashing, regulators have been taking increased action, which includes new legislation and improved enforcement instruments. Meanwhile, consumers and civil society groups have been launching legal proceedings against malfeasors. Such litigation is particularly prevalent in the United States, and some examples of greenwashing class action lawsuits filed in 2023 include Ellis v Nike USA, Inc. on Nike’s alleged misrepresentation of the sustainability of its “Sustainability” Collection Products, Peterson v Glad Products Co.on the alleged deceptive marketing of “recyclable” trash bags and Blackburn v Etsy Inc. on Etsy’s alleged false representations regarding its offsetting of carbon emissions from its shipping activities. Greenwashing has become a public concern over the actions of corporations due their sheer size and importance today, which means that they can play a significant role in either addressing or intensifying the climate crisis.

Some challenges on how best to address greenwashing arise from the fact there is no harmonized legal definition of the concept of greenwashing which varies by product, service, regulator and jurisdiction. Unsurprisingly, there isn’t much of a consensus on the role corporations can and should play in sustainability challenges. This is partly attributed to the ongoing development of data concerning the full scope of the climate crisis, which is being challenged by different corporate and political entities. Ongoing discussions persist regarding the specific measures corporations should take, irrespective of whether they are explicitly mandated or opt to participate in voluntary initiatives. In addition, some instances of greenwashing may be due to a confusion around the meaning of “ESG factors” and how they relate to the standards of “single” materiality or “double” materiality. The dominant standard against which “ESG factors” are currently being measured is one of single materiality, which assesses the impact of social and environmental factors on the financial performance of the company. For instance, higher future carbon taxes could increase production costs and a greater number of weather-related catastrophes, such as floods and storms, may increase the cost of insurance and the likelihood of property damage or trade disruption. A new standard of double materiality has emerged in recent years, which adds on to the standard of single materiality considerations of the impact of the company on the environment and social welfare. The concept of “double-materiality” was first formally proposed by the European Commission in the Guidelines on Non-financial Reporting: Supplement on Reporting Climate-related Information published in June 2019 and have since been taken up more widely, including in the International Sustainability Standards Board (ISSB) and the EU’s 2021 Corporate Sustainability Reporting Directive.

To ask how the problem of greenwashing can be effectively addressed is to ask who should bear the responsibility for stopping greenwashing and for promoting genuine sustainable behaviour on the part of companies. We have identified 5 main actors and we will be examining their strategies for addressing greenwashing in turn: board of directors of corporations, investors, consumers, international actors (including transnational bodies created through the collaboration of several governments as well as non-profits) and governments.

-

Board of Directors: an expansion of the fiduciary duty?

Boards of directors are the first actors one would expect to address greenwashing as they are key players in the management of the corporation. Three approaches emerge in the literature from law firms and legal scholars on the duties of directors regarding greenwashing. First, we see a descriptive approach, observing how boards are currently accepting responsibility for addressing ESG factors and thereby mitigating the risk of greenwashing. In the 2019–2020 NACD Public Company Governance Survey, nearly 80 percent of directors report that their boards are focused on some aspect of ESG, with 52 percent seeking ways to improve their individual understanding of ESG performance. Is that vague? Yes. Does it provide us with a prime example of greenwashing? Yes again. So, we see that even when we are discussing avoiding or combatting greenwashing, there are still ample opportunities to re-frame the information in a favourable light.

Secondly, we see prescriptive arguments, calling on boards to be held more responsible for addressing ESG factors. In particular, we find arguments grounded in fiduciary duties and the duty of care. Under the Canada Business Corporations Act, directors have a fiduciary duty to the corporation (CBCA para. 122(1)(a)) and a duty of care (CBCA para. 122(1)(b)), both of which require them to take the environment into account when considering the best interests of the corporation. One common question addressed is whether individual board members should be held personally liable for ESG decisions and greenwashing more specifically.

In a 2021 article for the Vanderbilt Law Review, Professor Cynthia Williams argued that the fiduciary duties of officers and directors should be expanded to ground the company’s duties to society generally. Williams cites Jaap Winter, for whom directors have “societal duties,” i.e., a duty to act responsibly with a view to the interests of society and a duty to use “investor, human, social and natural capital” responsibly. These societal duties would imply obligations for directors and officers to include climate change in their oversight, strategic direction of the company, and disclosure reports. They would be required to look at the emerging science of climate change when developing business strategies, forward-looking plans and commitments, and scenario analyses.

The idea is a powerful one: to harness the internal mechanisms of the firm, the private law of fiduciary duties of agents, and use it to advance external public goals. However, it is not realistic to expect that directors will voluntarily extend their fiduciary duties beyond the firm, and it is doubtful whether common law courts, wary of judicial activism, will be willing to make the common law evolve in such a direction. Instead, we believe that outward standards of responsibility brought into the firm through external mechanisms such as investor- and state-mandated ESG disclosure requirements, have a greater role to play. These are discussed further below under III and VI respectively.

We also find arguments proposing that boards should not be held responsible for promoting ESG factors. This position is more prominent in the US which is experiencing a wave of anti-ESG legislation. The legal argument advanced by proponents of anti-ESG legislation is that addressing ESG factors violates the fiduciary duty to maximize profits for shareholders. However, this seems to be a minority position in Canada because the scope of fiduciary duties has been more explicitly delineated in both business law statutes and jurisprudence to explicitly include considerations of the environment (see CBCA para. 122(1.1)(b)).

Lastly, the literature offers specific advice for how boards can address ESG factors more effectively, thereby reducing the possibility of committing greenwashing. Examples include: enhancing board diversity, increasing board expertise through training for board members and bringing in outside experts, creating internal policies that provide clear guidance on potential greenwashing risks and how they can be avoided or mitigated, and being specific when disclosing sustainable goals and outcomes.

-

Investors

Greenwashing needs to be understood in the context of the greater shift towards sustainable finance. From the days of Milton Freedman’s “sole responsibility to produce profits for shareholders,” we’ve since developed ethical investments that include environmental concerns, which “go beyond the balance sheet,” in the words of S&P Global. BlackRock CEO Larry Fink’s letters where he sets out specific expectations for climate leadership at the companies he owns, are an annual reminder that institutional investors are directing their attention towards the sustainability credentials of corporations.

Investors—which include banks, institutional investors like pension funds, and private investment companies like Black Rock—exert a large influence over corporations to which they provide funding. They thus have the capacity to impose environmental standards and disclosure obligations on corporations. For example, the Glasgow Financial Alliance for Net Zero (GFANZ) is a coalition of banks, insurance companies, asset managers, and asset owners representing 40% of the world’s financial assets that have pledged to cut emissions from their portfolios to reach net zero by 2050. These financial institutions now require companies that are seeking loans from them to have net zero commitments as well. The pressure from financial institutions can affect a company’s credit rating, valuation, and cost of capital to its ability to borrow and get insurance.

Why are investor interested in green assets in the first place? The short answer is: money. In the US S&P500 index, which tracks the performance of the 500 largest companies on US stock exchanges, 16 of 27 ESG investments outperformed the market in 2021. In Europe a sample of 745 Europe-based ESG funds shows that the majority have done better than non-ESG funds over three, five, and 10 years. Some of us may wish that investors turned to ESG out of a sense of responsibility, and not just to make money. Well, there is also an economic theory called “Warm-Glow Theory” which claims that investors gain non-pecuniary utility from the “good feeling” they get from ESG investing. This is relevant to greenwashing because firms can take advantage of investor warm-glow bias, by appearing to be sustainable without taking real action.

The role investors play in greenwashing is dual, both as victim and perpetrator. Firms they invest in might be greenwashing, but investors themselves can greenwash, too. If investees greenwash, this can be a barrier to integrating ESG factors into investment decisions and discourage investors from paying for green stocks. Meanwhile, asset managers like BlackRock and State Street are fearing greenwashing lawsuits themselves. The Australian Securities & Investments Commission (ASIC) recently accused Vanguard of making “false and misleading statements” regarding their ethically conscious hedge funds in Australia. In 2023, over a quarter of S&P 500 shareholder proposals requested that companies analyze the “misalignment” between stated values and corporate action across social issues, suggesting that investors are clearly aware of the risk of greenwashing by companies they invest in.

Scholars are divided as to whether market forces are enough to promote sustainable finance. On the one hand, Yu & al.’s empirical research of 2020 suggests that greenwashing can be deterred with greater scrutiny of firms’ behaviour. Yu & al. find that increased institutional ownership and a higher share of independent directors are most effective in reducing firms’ greenwashing behavior, even more so than public interests. Giovanni Strampelli of Bocconi University, however, disagrees. In a competitive market, corporations have difficulties coordinating their activities towards a common altruistic purpose, such as fighting climate change. He argues that we shouldn’t expect that institutional investors will chose to voluntarily internalize costs by investing resources with the aim of promoting ESG. Government intervention may still be necessary to outweigh the countervailing market pressures to act self-interestedly and for the short-term. This could take the form of a rethinking of fiduciary duties as applicable to institutional investors, as discussed in II, tax benefits for investors to engage in sustainable investing, or more stringent taxonomy and securities regulation on disclosures, as discussed below in VI.

-

Consumers

Consumers can bring corporations they believe are greenwashing before the court. Consumer class actions have important reputational consequences for the corporation in addition to financial costs that can lead to widespread negative media coverage and consumer boycotts. A 2023 report by the Grantham Research Institute on Climate Change and the Environment finds an emerging trend of strategic greenwashing litigation whose aim is not necessarily to “win” the case but to create negative publicity that deters consumers and investors from purchasing or investing in the greenwashers’ products and services. This shows that consumers are more than ever intent on calling out companies that engage in greenwashing practices and dissuading others from purchasing their products.

Greenwashing litigation is wide-ranging and can target many aspects of greenwashing, such as (1) corporate commitments (esp., “net zero” or “carbon neutral” targets), (2) product attributes (e.g., are single-use coffee pods really recyclable?), and (3) disclosure of climate investments, financial risks and harm caused by companies. However, consumers are not necessarily the best placed to bear the burden of the fight against greenwashing. Litigation is expensive, stressful, and time-consuming, and it only addresses one misfeasor at a time. It isn’t fair to rely on the resources of private individuals to address an issue of public concern such as greenwashing and the promotion of sustainable corporate practices. Which is why consumers themselves have also turned to suing governments for more comprehensive legislation around greenwashing and the climate in general (see Mathur v. His Majesty the King in Right of Ontario, 2023 ONSC 2316, and Environnement Jeunesse c. Procureur général du Canada, 2019 QCCS 2885).

-

Collaboration among states; international NGOs

States have joined forces to attempt to address greenwashing more effectively across borders, by creating voluntary frameworks, and sometimes even enacting mandatory laws such as the Sustainable Finance Disclosure Regulation (SFDR), an EU Law adopted in 2021. NGOs too, like the Carbon Disclosure Project (CDP), have proposed their own disclosure systems. We tend to assume that such frameworks mainly impose ESG disclosure requirements on companies, but in fact, different frameworks apply to different actors. For example, the SFDR is directed at investment firms while the Carbon Disclosure Project is addressed at cities and states, in addition to companies. Below is a summary of some of the main disclosure frameworks for ESG factors. Some have criticized the “alphabet soup” of competing, overlapping, complementing or conflicting ESG standards, arguing that it contributes to the problem of greenwashing by allowing corporations and investors to pick and choose the most advantageous disclosure framework to them.

Sustainable Finance Disclosure Regulation (SFDR).

The SFDR of 2019 has become a fundamental pillar of the EU Sustainable Finance agenda, since it was introduced by the European Commission as a core part of its 2018 Sustainable Finance Action Plan. Since 2021, the SFDR requires EU investment firms to disclose their approach to the consideration of ESG factors in their investment decisions and to make disclosures for investment products that take into account ESG factors, regardless of if they identify themselves as an “ESG-focused” financial firm. The SFDR primarily applies to EU-based financial institutions with over 500 employees and all financial market participants (FMP).

Carbon Disclosure Project (CDP)

The Carbon Disclosure Project is a UK-based not-for-profit operating since 2000 that has offices in 50 countries. Today, corporations and governments (at all levels, from municipal to federal) from over 90 countries report to CDP. Globally, CDP reporting is the most widely used sustainability and carbon disclosure rating system.

The CDP encourages businesses to voluntarily report every year on various climate, supply chain, and environmental indicators. Information disclosed through the CDP framework includes climate change impacts, including greenhouse gas emissions and energy data, water impacts, including use efficiency, quality, and ecosystem management, and forest impacts for companies that engage in commercial agriculture. The CDP also provides support and reporting opportunities to cities, states, and regional governments to demonstrate progress on their sustainability challenges and unique climate impacts. Reports are publicly available and included in annual aggregate reports on supply chains, water risk management, climate, forests, and other criteria.

The number of cities, states, regions, and companies voluntarily reporting to CDP has grown yearly. From 2021 to 2022, there was a 38% increase in reporting organizations. In 2022, over 18,700 companies representing half of the total global market capital—that’s $60.8 trillion—and 1,100 cities and governments disclosed their environmental performance, providing an invaluable method for data collection for investors and diverse stakeholders.

Task Force on Climate-related Financial Disclosures (TCFD)

Since its launch in 2017, the TCFD has been the leading voluntary climate disclosure framework. Created by the G20’s Financial Stability Board, the TCFD has produced a disclosure framework requiring businesses to identify, manage, and report on climate-related risks that has been adopted widely around the world, including by the Canadian government and many Canadian institutional investors. TCFD supporters span 89 countries and jurisdictions and nearly all sectors of the economy, with a combined market capitalization of over $25 trillion.

The TCFD’s Final Report details 11 voluntary recommendations of disclosures structured around four core operational themes, with associated targets: Governance, Strategy, Risk management, and Metrics. The TCDF has become a common reference point across global financial policymakers and regulators, with the UK Financial Conduct Authority, European Commission and Hong Kong Monetary Authority all referencing it as a model for their proposed disclosure frameworks. One of the reasons for TCFD’s success is the framework’s balance between universal reporting requirements and additional industry-specific disclosures which appeals to regulators mindful of the costs of disclosure, especially for smaller entities.

The TCFD will be merging with the ISSB starting in 2024.

International Sustainability Standards Board (ISSB)

The ISSB was established at the Cop26 in 2021 with the intention of summarizing all existing reporting standards, mainly drawing on the TCDF. Several versions of the standards were released, until the ISSB became sufficiently accepted and used to completely take over and continue TCFD’s uniformization goals.

This October, it was announced that TCFD’s monitoring responsibilities will be transferred to the ISSB in 2024. The recently published ISSB Standards—IFRS S1 and IFRS S2—incorporate TCFD recommendations and will be globally implemented from 2024. IFRS S1 focuses on disclosing sustainability-related risks and opportunities, while IFRS S2provides specific climate-related disclosures to be used alongside IFRS S1.

-

Government

Governments already have a number of laws to address certain aspects of greenwashing. In Canada, the Competition Act,the Trademarks Act, and the Consumer Packaging and Labelling Act all prohibit false or misleading representations regarding a company’s products or those of a competitor, as well as performance claims based on inadequate testing. These laws would catch greenwashing perpetrated by corporations, including the recyclable coffee pods example mentioned above. The Competition Bureau in Canada actively investigates and enforces these laws. Examples of enforcement include a $3 million penalty for false coffee pod recycling claims by Keurig Canada and a $15 million penalty for misleading marketing of vehicles as environmentally friendly by Volkswagen and Audi.

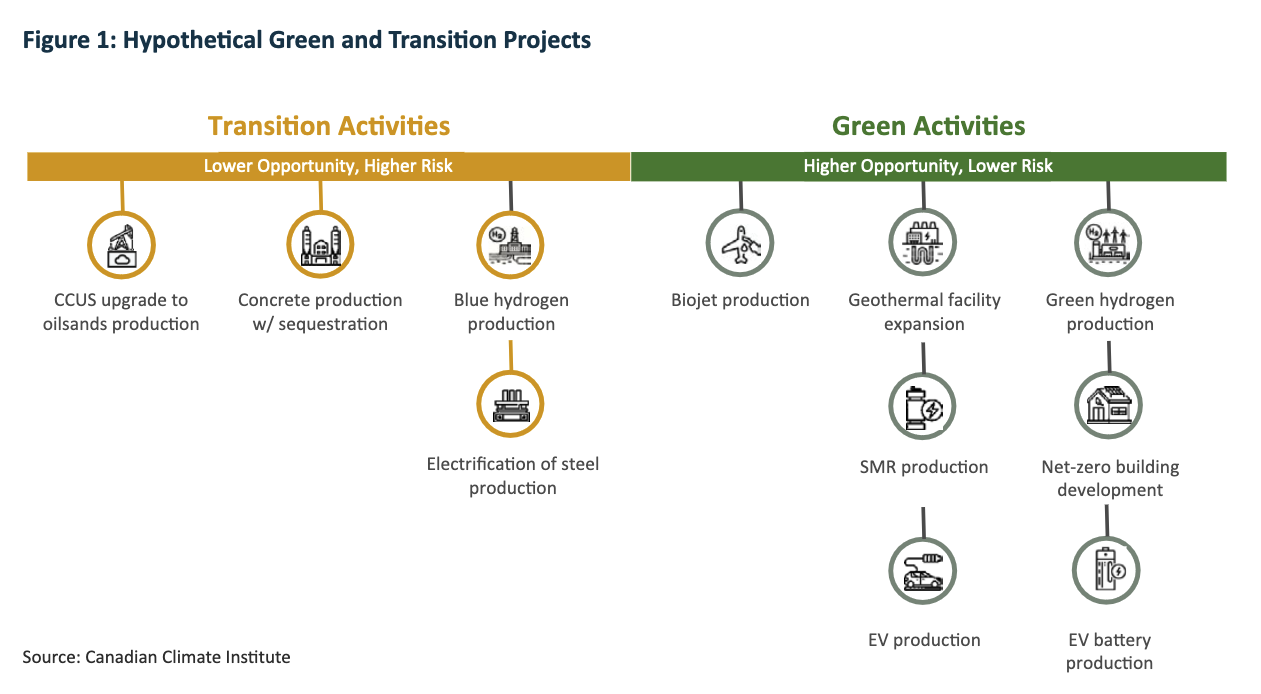

To address greenwashing in the characterization of ESG funds, taxonomy regulations are emerging as a new trend. Taxonomy regulations establish a classification system (a taxonomy) which provides businesses with a common language to identify whether or not a given economic activity should be considered “environmentally sustainable”. In 2022, the Canadian Sustainable Finance Action Council (SFAC) released the Taxonomy Roadmap Report. The Report contains 10 recommendations addressing the merits, design and implementation of a green and transition finance taxonomy for Canada and plans for the publication of a complete taxonomy by 2025. The Canadian taxonomy initiative takes inspiration from the EU’s Sustainable Finance Taxonomy which is law since 2020. The Regulation (EU) 2020/852 on establishing a framework to facilitate sustainable investment sets out 4 overarching conditions that an economic activity has to meet in order to qualify as environmentally sustainable: (1) contribute substantially to one or more of the environmental objectives set out in the regulation, (2) not significantly harm any of these environmental objective, (3) be carried out in compliance with the minimum safeguards set out in the regulation, (4) comply with the technical screening criteria set up by the European Commission in accordance with the regulation. The Regulation requires the Commission to set out a list of environmentally sustainable activities by defining technical screening criteria for each environmental objective. These criteria are established by means of delegated acts, including the Climate Delegated Act (Delegated Regulation (EU) 2021/2139) and the Disclosures Delegated Act (Delegated Regulation (EU) 2021/2178).

(source: Taxonomy Roadmap Report)

The Canadian and US governments are also addressing greenwashing through securities regulation. It is important to note the difference in organizations between the securities regulators here and in the US. Canada has a decentralised securities regulation model with provincial/territorial regulators creating their own policies. The Canadian Securities Administrators (CSA) is an umbrella organization that issues non-binding guidance with the goal of harmonizing regulations across Canadian capital markets. Conversely, the US Securities and Exchange Commission (SEC) is federally mandated, giving the SEC broad authority to regulate the securities industry.

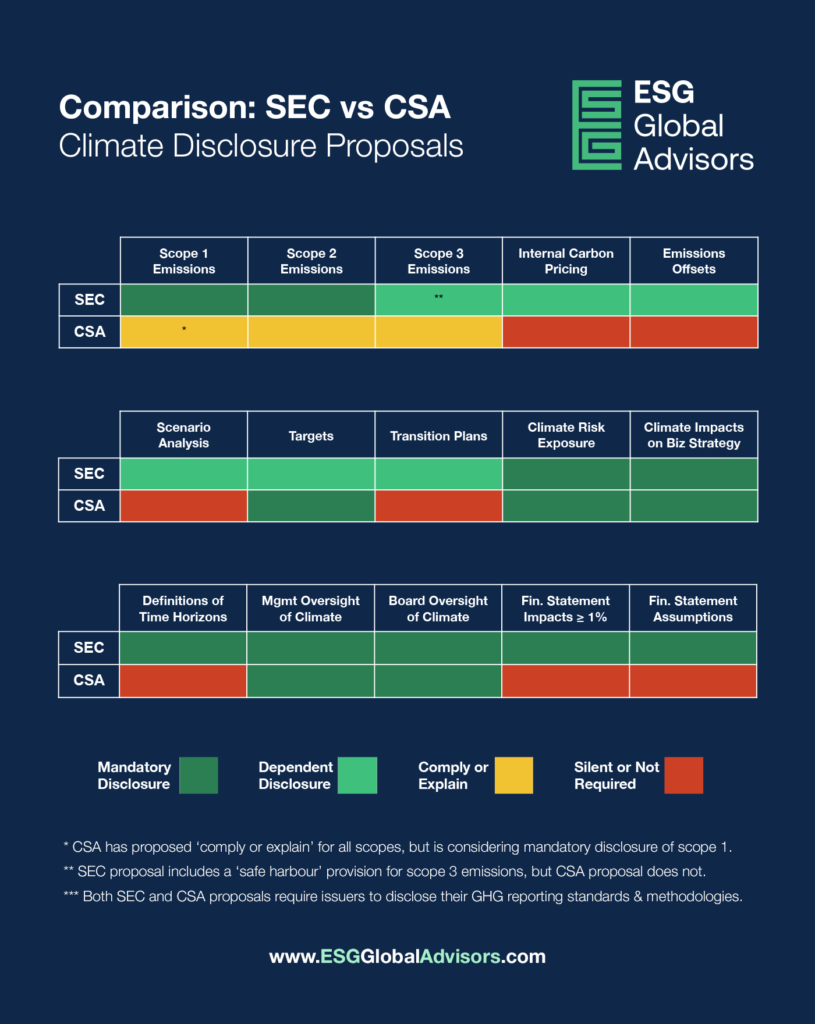

Both the CSA and SEC have released two proposals addressing climate disclosures for investors. The CSA Notice 51-107Climate-related Disclosure Update & Proposed National Instrument was announced on October 18, 2021 and has yet to be adopted. The SEC Proposal to Enhance and Standardize Climate-Related Disclosures for Investors was announced on March 21, 2022. It, too, has yet to be adopted, and is undergoing consultations. Both proposals have 5 key regulatory focuses: GHG emissions, transition management, risk exposure and impacts, governance and oversight, and financial statements.

When it comes to greenwashing, the CSA notice proposes several measures. For example, the name and investment objectives of a fund must accurately reflect the degree to which the fund is focused on ESG factors. The CSA notice would also impose disclosure requirements of risk factors of ESG-Related Funds such as risks associated with reliance on third-party ESG ratings regarding performance assessments. Finally, the CSA notice reiterates the familiar prohibition against untrue or misleading marketing communications of ESG-Related Fund.

Between the two, the SEC’s proposal is the more robust one and will therefore likely become the disclosure framework adhered to by cross-listed issuers in Canada and the US. The Canadian proposal relies more heavily on a “comply or explain” model whereas the US proposal mandates mandatory or dependant disclosures. In a globalized economy, Canada may benefit from the SEC’s robust regulations if corporations want to operate across US-Canada borders, forcing them to adhere to higher disclosure standards. However, in its current form, the CSA proposal itself is unlikely to create meaningful action against greenwashing without amendments to include more stringent disclosure requirements that provincial authorities would adopt and enforce in their respective jurisdictions.

(Source: SG Global Advisors, A Comparative Analysis of U.S. (SEC) and Canadian (CSA) Climate Disclosure Proposals, June 9, 2022)

Where do we go from here?

The responsibility for addressing greenwashing does not and should not weight on one single actor’s shoulders. It makes sense that addressing greenwashing requires different instruments since different groups are to be protected from it, from investors to consumers. We believe that these different groups have a responsibility to make themselves aware of and keep up to date with the existing regulations that protect them. Consumers should know to refer to consumer protection laws and address their complaints to the Competition Bureau in Canada or other provincial agencies. Investors and companies can rely on securities regulations and ESG disclosure frameworks that have been entrenched in legislation.

We believe that the alphabet soup argument, which claims that the plethora of ESG reporting standards is contributing to greenwashing, is losing strength. Regulations will become more and more unified through international agreements and their internalization by corporate actors as strong industry norms. We are already seeing this happen, with the merger of the TCDF and ISSB standards and the growing number of companies, investors, and governments adhering to voluntary disclosures. We are noticing a promising current of uniformized action led by international norm-making bodies, such as the TCFD, and later transposed to countries’ regulators’ actions. It’s only been 6 years since the release of the Task Force on Climate-related Financial Disclosures (TCFD), and countries representing major market forces are already implementing legislation following its guidelines. While non-state and market actors are important, we believe that governments need to take on a more active role in leading the battle against greenwashing. This should take the form of more ambitious taxonomy and securities regulations, that are adequately enforced by governmental agencies, as well as legislative initiatives that go beyond disclosure requirements to promote sustainable corporate actions through tax penalties or incentives.