Introduction

Think back to October 2019. You are Adam Silver, chief executive of the NBA. Houston Rockets general manager Daryl Morey tweets support for Hong Kong pro-democracy protests. Tilman Fertitta, the Rockets owner, disowns Morey's position. China bans coverage and lodges a diplomatic complaint. Democrat and Republican lawmakers slam the NBA's weak response. NBA fans and players begin to protest and voice support for Hong Kong and Morey. Nike pulls Houston Rockets merchandise from Chinese stores. For context, 640 million Chinese watched the 2017-18 season.

So, what do you do?

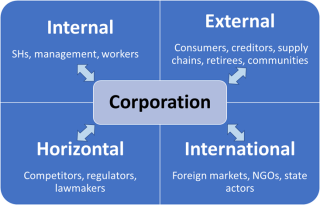

Corporations can no longer hide behind a facade of neutrality. As they grow in size and scope, their decisions impact the daily lives of millions in real time. In the age of social media and political polarization, corporations are compelled to take positions publicly and visibly, even if they are reluctant to do so. They must constantly balance and re-balance between a bewildering array of competing interests, including shareholders, employees, creditors, consumers, competitors, supply chains, regulators, legislators, politicians, activists, NGOs, celebrities, foreign governments, and international markets. Corporate lawyers must be alive to this evolving dynamic.

Why it matters

How a corporation navigates political controversy today will determine its success tomorrow. Its ability to do so matters for three reasons. First, political controversy is not only a source of significant risk, but also an opportunity. Second, the way ahead is unclear. Corporate law imposes duties and obligations to address shareholder and stakeholder interests, but with little practical guidance on how to do so. Yet, directors and senior officers must make decisions daily to steer their corporations through the political maelstrom. Third, political controversy is amplified through social media like never before. Their users, quick to pass judgment, have expectations of corporations that go far beyond a simple duty to maximize shareholder wealth.

Elon Musk’s 2022 takeover of Twitter provides a timely example. In 2017, only 7% of top CEOs were personally active on Twitter. Today, it is at the centre of a raging debate on free speech and the proper role of private corporations in the world’s digital town square. Musk promised to restore free speech while preventing the platform from descending into a “hellscape.” He privatized the company, laid off half of its 7,500 employees, eliminated board oversight, and relaxed content moderation. Large advertising firms immediately reduced their exposure to the platform, prompting questions about Twitter’s legal risks and its ability to pay its creditors. Ignoring warnings from Twitter’s staff, Musk rolled out a monthly “Twitter Blue” subscription model for verified users. Predictably, new ‘verified’ users began to impersonate real accounts. Pharmaceutical giant Eli Lilly was impersonated in a tweet promising free insulin. Three hours and thousands of retweets later, its stock had dipped 4.7% (a reported 15 billion dollar loss), and the company halted advertising on the platform. In less than a month, Musk had driven away half of Twitter’s top 100 advertisers. He has since paused the verification program.

Key positions: Shareholder versus stakeholder capitalism

The shareholder versus stakeholder capitalism debate casts a long shadow over corporations confronting political controversy. In 1970, Milton Friedman famously proclaimed that “the social responsibility of business is to increase its profits.” He argued that when corporate officers act for the social good, they violate the principal-agent relationship. In other words, they fund personal projects with other people’s money. Contemporary shareholder capitalists like Vivek Ramaswamy argue further that when companies try to do ‘good,’ they poison democracy and accelerate political polarization. Citizens and governments, not executives, should tackle social issues. Political controversy is to be avoided, lest it interfere with the responsibility to increase shareholder profit.

Yet as Jeffery Sonnenfeld points out, Ramaswamy’s position is unsupported by data. For example, Sonnenfeld’s research suggests that corporate responses to the recent US Supreme Court Dobbs abortion decision were driven by “geography, the workforce and a firm’s customer base” rather than “the personal politics of a given boss.” In short, controversial decisions taken by corporations are not driven by the elite at Davos. Rather, they are calculated business decisions.

The shareholder capitalism argument remains highly influential, but it is showing its age. The negative externalities of climate change, amongst others, have grown too large to ignore. Stakeholder capitalism - the idea that corporations should serve the interests of all their stakeholders, appears to be gaining ground. Friedman himself acknowledged that “it may well be in the long‐run interest of a corporation that is a major employer in a small community to devote resources to providing amenities to that community or to improving its government.” Further, more people than ever now profit from the corporate form. In Friedman’s time, around 10% of American households directly held shares. By 2019, it was 53%. A growing number of people are both shareholders and stakeholders with interests beyond the quarterly bottom line.

False dichotomies

The stakeholder versus shareholder capitalism debate invokes a false dichotomy that is no longer relevant or useful in helping corporations navigate today’s complex operating environment. Shareholder primacy has long been the overriding concern when making boardroom decisions. This premise remains fundamental, but shareholder interests no longer offer directors a straightforward answer to how they should run corporations, because “[s]hareholders today are not a monolithic interest bloc.” Increased awareness of ‘environmental, social, and governance’ (ESG) issues means that shareholder and stakeholder interests converge more frequently, and the ubiquity of social media accelerates their interaction.

The financial incentives that drive corporations no longer stand in isolation from other societal interests. Corporations have grown in size and scope, such that their positions on politicized issues impact the daily lives of millions. In July 2022, the Securities and Exchange Commission announced plans to ease barriers for shareholder proposals. In the 1980s, shareholder proposals to divest from ethically dubious supply chains were dismissed as not being related to the best interests of the corporation. Today, the practice is mainstream.

This leads to the conclusion that the question facing corporations today is no longer whether to engage in political controversy, but which issues to engage in and how to do so. The challenge lies in navigating the oftentimes conflicting interests between shareholders and stakeholders. For example, Disney tried to remain silent and neutral when Florida passed the Parental Rights in Education Act, known as the “Don’t Say Gay law,” in March 2022. The law forbids early grade instruction on gender and sexual orientation. Employee protests finally pushed Disney’s Chief Executive Officer (CEO) Bob Chapek to speak out against the law. The Florida Governor retaliated by withdrawing Disney’s special tax status.

Corporate law is an unhelpful guide to navigating political controversy – but does it have to be? Amendments to the Canadian Business Corporations Act subsection 122(1.1) acknowledge that the “best interest of the corporation” may require directors and officers to consider other stakeholder interests. However, the act provides little guidance on how to balance them. The jurisprudence does little better.

To successfully navigate a political controversy, directors should articulate their corporation’s purpose and position before one arrives at their doorstep. They cannot afford to bury their heads in the sand. For example, on June 24, 2022, Bank of America announced an expansion of employee healthcare coverage and funding for travel expenses for abortions — the very same day that the US Supreme Court overturned Roe v Wade. In 2015, the company was already matching their employees’ donations to Planned Parenthood. It was only able to react to the Dobbs decision so quickly because it had already taken a stance on the issue.

The path ahead is neither straightforward nor easy. What emerges however, is that the deceptively neat distinction between governmental ‘intervention’ and market self-regulation prevents us from realizing the transformative opportunities that a closer collaboration between private and public actors can enhance. Such opportunities exist, even where the dominant mantra suggests a “never” or “later, perhaps”.

As external actors apply intensifying pressure for corporations to do ‘good,’ shareholders and creditors are not letting corporations jettison their duty to book a profit. While major banks supported post-Dobbs abortion rights and gender equality, they also provided financial support to lawmakers who backed anti-abortion legislation. The NBA has quietly returned to Chinese screens, despite its prior objections to Chinese conduct in Hong Kong. In Florida, Disney remains silent as Governor Ron DeSantis moves to target gender-affirming care for trans youth. It now appears that former Disney CEO Bob Iger will replace Bob Chapek, despite a previous board decision to renew Chapek’s contract for three years.

Conclusion

Corporate lawyers must be alive to the effects of political controversy, including the risks and opportunities it presents. Above all, they must prepare to navigate it in the face of legal ambiguity. They must avoid zero-sum or binary thinking that pits profits against broader interests. Lawyers must keep abreast of emerging theories like corporate political responsibility, as consumers, employees, and regulators demand more serious engagement with corporate social responsibility and ESG. They must attend to, and advise their clients of, the new costs of doing business.

The corporate landscape has changed, and it shows no signs of reversing course. Speaking to the Disney controversy, Martin Whittaker, CEO of Just Capital, a leading nonprofit engaged in stakeholder capitalism, emphasizes that “this is not going away, and it's not just about LGBTQ rights. There's a broader shift that's happening.” The issue is about the “role business plays in society.” For any large corporation, the need to navigate a political controversy is a matter of time. Corporations must learn how to do so if they are to chart a course through the storms coming their way.