Who is covered by this Collective Agreement?

This Collective Agreement covers the working conditions of unionized postdocs, i.e. Postdoctoral Researchers (Group C) who receive more than 25% of their total income from McGill funds.

What is the effective date of the Collective Agreement?

The Collective Agreement was signed on June 16, 2023. The new salary minimum of $41,500 is effective as of June 4, 2023. The minimum salary will increase to $45,000 as of June 2, 2024.

What if the postdoc’s supervisor is unable to meet the minimum salary defined in the Collective Agreement?

All newly hired unionized postdocs must receive at least the minimum salary specified in the Collective Agreement. Supervisors should budget accordingly and contact their department’s Finance officer for assistance, if needed. Note that postdoctoral contracts are granted based on funding.

How does the Collective Agreement affect non-unionized postdocs?

Non-unionized postdocs are not covered by the Collective Agreement. To review the different postdoctoral categories at McGill, consult this page. Note, however, that the same minimum salary is recommended for non-unionized Postdoctoral Researchers. The minimum appointment duration of 12 months or greater also applies to all postdoc categories.

Do international postdocs require a new work permit if their salary increases as a result of the new Collective Agreement?

Most international postdocs in Group C have a closed work permit that is employer-specific, resulting from an Offer of Employment in the Employer Portal. Unionized Postdoctoral Researchers on a closed work permit whose salary increase stems from the Collective Agreement are not required to obtain a new work permit.

Non-unionized Postdoctoral Researchers on a closed work permit will require a new work permit if they become unionized because of the salary increase, as this will be considered a change in conditions. Note that the change in conditions can only go into effect after the new work permit is issued or the request for interim authorization to work has been approved. Retroactive changes are not allowed as doing so would make McGill non-compliant. Contact immigration.apo [at] mcgill.ca for guidance on this.

Postdocs on an open work permit (not employer-specific, not resulting from an Offer of Employment in the Employer Portal) are not required to obtain a new work permit after a salary increase.

What are the implications of a McGill top-up for Postdoctoral Fellows (Group A)?

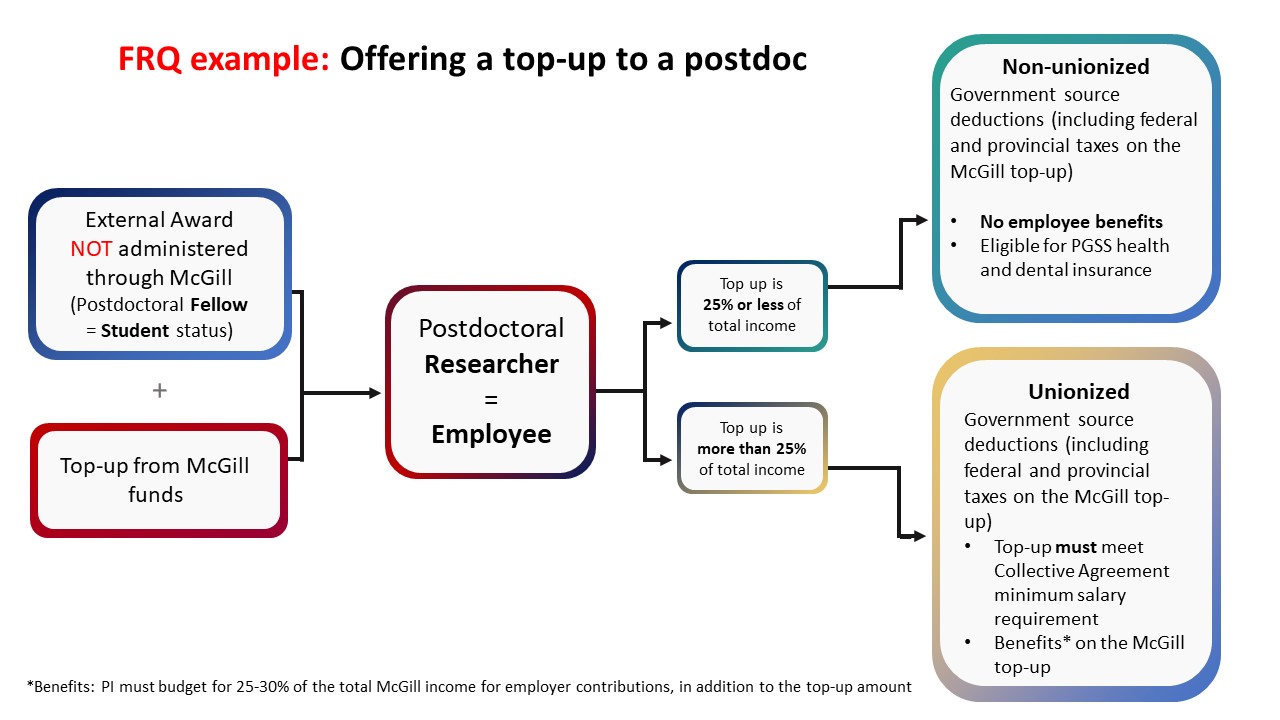

When a postdoc receives external funds directly from the awarding agency (Group A – Postdoctoral Fellows), they are considered students, not McGill employees. Offering a top-up to increase their salary puts them in the Postdoctoral Researcher category (Group C) as a McGill employee subject to government source deductions, including federal and provincial taxes, on their McGill salary.

The postdoc's total combined income must be considered when determining their status (unionized or non-unionized). The total income includes all sources of funding (external award and McGill top-up combined).

If the top-up represents 25% or less of the postdoc's total combined income, the postdoc is non-unionized.

If the top-up represents more than 25% of the postdoc's total combined income, the postdoc is unionized. Compliance with the Collective Agreement must then be respected. The Collective Agreement minimum salary requirement is based on the total salary paid through McGill Payroll (in this case the top-up). The top-up must therefore meet the minimum salary requirement specified in the Collective Agreement ($45,000 plus benefits as of June 2, 2024).

In addition, the supervisor offering the top-up must ensure there are enough funds to cover all the employer contributions (statutory government deductions and McGill benefits). It is recommended to budget 25-30% of the total McGill salary for employer contributions (exact amount depends on the postdoc’s benefit selections and salary).

Because of the above considerations (change in postdoc category and subsequent deductions at source), Postdoctoral Fellows (Group A) may decide to opt out and decline a top-up. This implies that the right calculations have been done and communicated to the postdoc.

Consult this PDF document for examples of a top-up given to a Postdoctoral Fellow who holds a FRQ fellowship paid to them directly.

Consult the graph below for an overview of implications regarding a top-up.

What are the implications of a McGill top-up for Postdoctoral Scholars (Group B)?

When a postdoc is paid by external funds administered by McGill (Group B – Postdoctoral Scholar), they are considered students, not McGill employees. Offering a top-up to increase their salary puts them in the Postdoctoral Researcher category (Group C) as a McGill employee subject to government source deductions, including federal and provincial taxes.

The postdoc's total combined income must be considered when determining their status (unionized or non-unionized). The total income includes all sources of funding (personal award administered by McGill and McGill top-up combined).

If the top-up represents more than 25% of the postdoc's total combined income, the postdoc is unionized and will receive full McGill benefits through source deductions and employee/supervisor contributions applied on the total salary.

If the top-up represents 25% or less of the postdoc's total combined income, the postdoc is non-unionized but will still be subject to government source deductions.

As a result, a postdoc who is offered a top-up may be earning a higher salary but taking home a smaller pay. In addition, the supervisor offering the top-up must ensure there are enough funds to cover all the employer contributions (statutory government deductions and McGill benefits). It is recommended to budget 25-30% of the total income for employer contributions (exact amount depends on the postdoc’s benefit selections and salary).

Because of the above considerations (change in postdoc category and subsequent deductions at source), Postdoctoral Scholars (Group B) may decide to opt out and decline a top-up. This implies that the right calculations have been done and communicated to the postdoc.

Consult this PDF document for examples of a top-up given to a Postdoctoral Fellow who holds a Tri-Agency fellowship paid to them directly.

Consult the graph below for an overview of implications regarding a top-up.

This work is licensed under a

This work is licensed under a