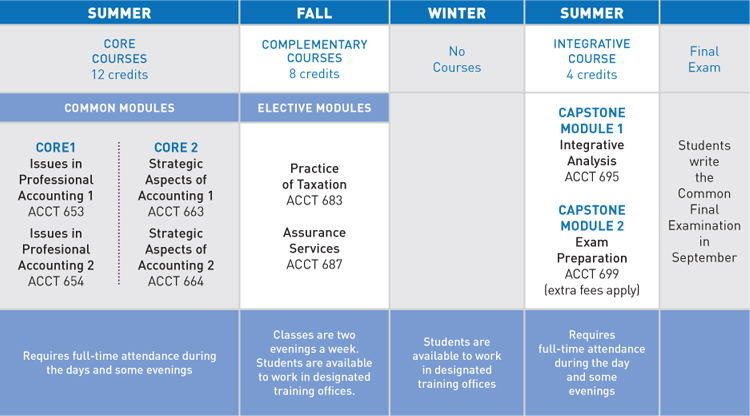

The Graduate Certificate in Professional Accounting (GCPA) program consists of eight courses, for a total of 24 credits. There are four three-credit courses, three four-credit courses, and a zero-credit Exam Prep course. The program at Desautels takes 16 months to complete with courses offered lock-step over three terms: summer, fall, and summer. The program requires students to attend full-time in the two summer terms. In the fall term students normally attend school part-time; no courses are taken in the winter term. During the fall and winter terms students usually work as part of the training period required to meet the requirements of the CPA designation. In the final summer term of the program students enroll in the final course as well as the Common Final Exam Prep Seminar, an intensive preparation course for the CFE. Additional fees are required for this seminar.

The Program Structure*

Common Modules

ACCT 653 - Issues in Professional Acct 1

ACCT 654 - Issues in Professional Acct 2

*Notes:

- Currently, for students admitted to the full-time GCPA Program at the Desautels Faculty of Management the only complementary courses that will be offered during the program will be those that allow CPA’s to practice Public Accounting (Practice of Taxation and Assurance Services). Students wishing to pursue other CPA paths such as Financial Analysis or Performance Measurement (management accounting) should apply to the National program.

Students who fail one course will be required to either write a second exam or repeat the course and will be placed on Probationary Standing. Students who fail two courses or one course and its second exam will be required to withdraw from the University.